self employment tax deferral turbotax

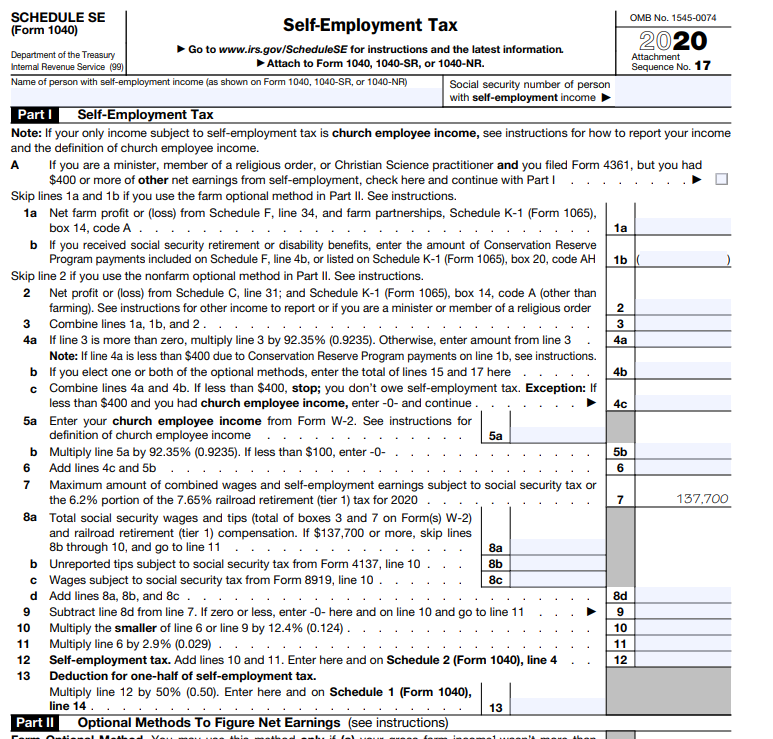

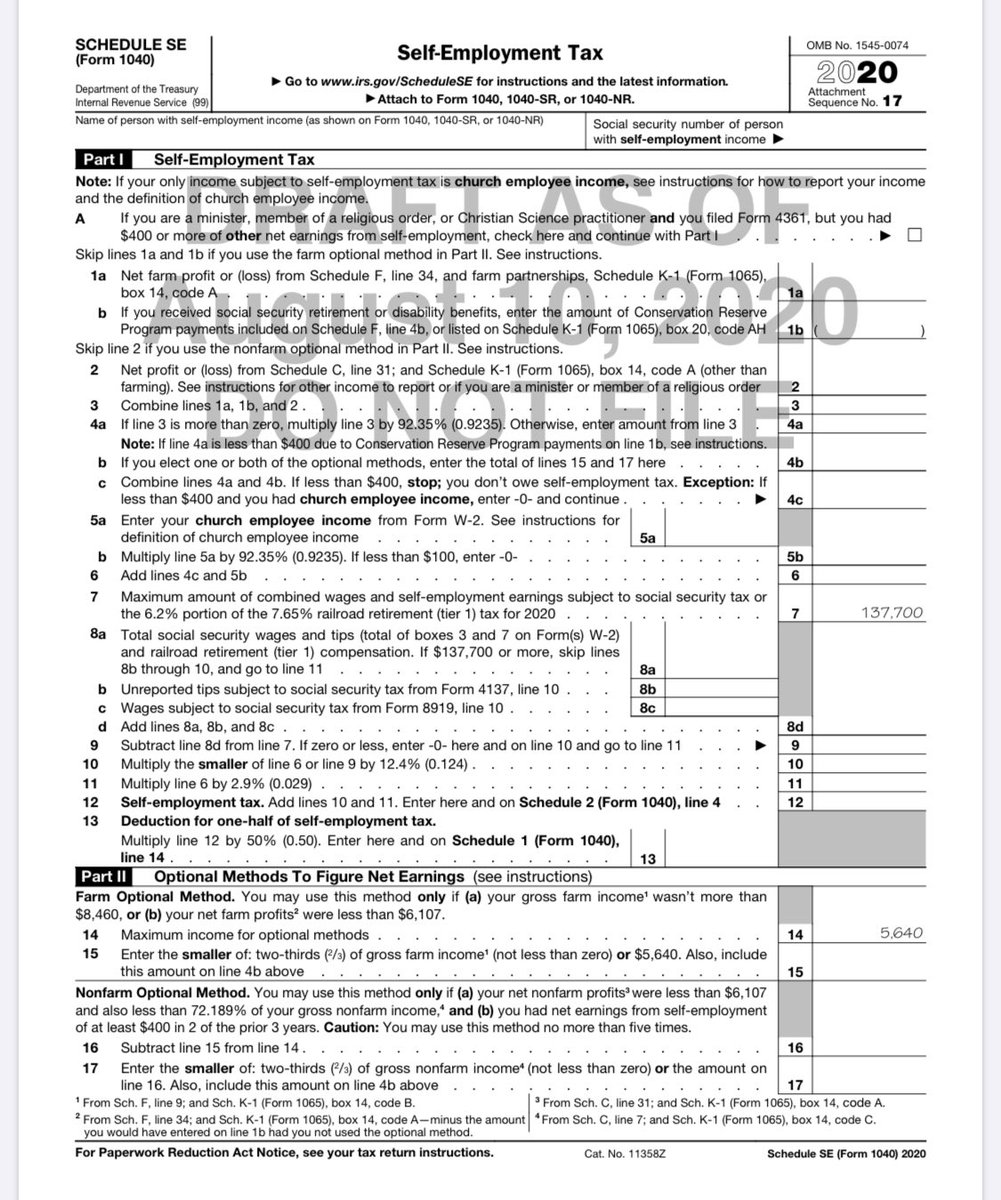

Line 18 is for the total. Deferral Of Self Employment Tax Turbotax.

2021 Tax Returns What S New On The 1040 Form This Year Kiplinger

You can delete your election to defer your self-employment taxes from your tax return.

. Know how much to set aside for 2021 taxes with. Self-employed taxes This free tax calculator helps you see what you may get back or what you might owe before you file your tax return. Available for employers and self-employed Estimate how much cash you can get from ERC paid leave and a tax deferral Retain employees and you might qualify for a credit of up to 5000.

It could be a tax knowledge or Language barrier. To delete or edit the election to defer your self-employment taxes do the following in TurboTax. According to the IRS self-employed individuals may defer the payment of 50 percent of the Social Security tax imposed under section 1401a of the Internal Revenue Code.

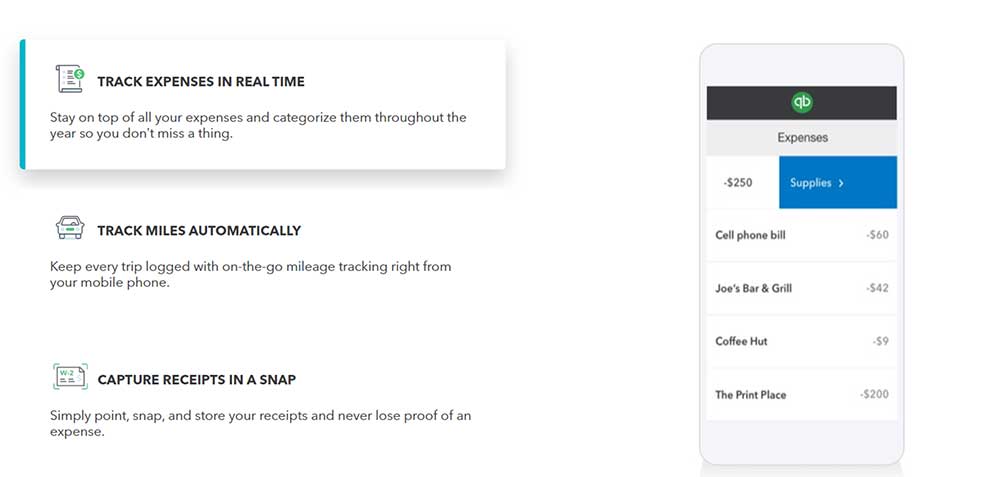

What is maximum deferral of self-employment tax payments TurboTax. See anything about the deferred self-employment tax on any of those draft forms. Perfect for independent contractors and small businesses.

Of course these are just drafts but it seems likely that the deferred tax is not going to. According to the IRS self-employed individuals may defer the payment of 50 percent of the Social Security tax imposed under section 1401a of the Internal Revenue Code. How a payroll tax relief deferral may help self-employed people In total self-employment taxes usually add up to 153 of a self-employed persons net earnings from self.

Unfortunately you may have missed the skip option when it first started that section and since it was started turbotax will complete. Since TurboTax is trying to calculate a tax deferral payment for self-employment tax then you need to go back into that section of your return and enter that you want 0 self. TurboTax Self-Employed 2021-2022 Taxes Uncover Industry-Specific Deductions TurboTax Self-Employed Personal business income and expenses 46 5.

However the credit you may be seeing is half of your self-employment tax that is. TurboTax Self-Employed will ask you simple questions about your life and help you fill out all the right forms. According to the maximum deferral of self-employment tax payments that TurboTax supports the SE-T is a self-employment taxpayer form.

Open your return If you open to the Hi lets keep working on your taxes. Note that the deferral is only on the Social Security.

Tax Reform How Physicians And The Self Employed Are Affected Physician On Fire

Glen Birnbaum On Twitter Taxtwitter Se Tax Deferral Mechanics From Cares Act Draft Form Sch Se Released Overnight Https T Co Gdowpkbloj See Page 2 Maximum Deferral Of Self Employment Tax Payments Looks Like

What Is A Schedule C Tax Form H R Block

Last Minute Tax Filing Tips Forbes Advisor

Self Employed Use These Deductions To Save Thousands At Tax Time

Solo 401k Contribution Limits And Types

Do Not Want To Do Self Employment Tax Deferral And It Will Not Let Me Opt Out Any Suggestions To Overide

What The Self Employed Tax Deferral Means Taxact Blog

14 Tax Tips For The Self Employed Taxact Blog

How Self Employed Individuals And Household Employers Can Repay Deferred Social Security Tax Tax Pro Center Intuit

2021 Instructions For Schedule H 2021 Internal Revenue Service

Self Employed Tax Software Calculator Quickbooks

Intuit Reports Strong Full Year Results And Sets Fiscal 2023 Guidance Business Wire

Reminder Half Of 2020 Deferred Fica And Self Employment Taxes Are Due December 31 2021 Marks Paneth

Solo 401k Contribution Limits And Types

How To File Taxes As A Blogger With Free Turbotax Self Employed Giveaway

Self Employed Use These Deductions To Save Thousands At Tax Time